Bitcoin is a revolutionary technology that’s been compared to owning a piece of the internet during the dot com era as an investment, if something like that was possible.

Not only does the cryptocurrency have potential as a global settlement layer, it also could someday replace all fiat money, and is already hard at work demonetizing gold as a store of value.

This new digital gold is unlike anything else on the planet, and other cryptocurrencies called altcoins have been created since in its likeness, each offering a wealth of additional features and benefits. But can any actually beat Bitcoin – the current best crypto on the market – or should you just buy Bitcoin and stick with that? The next question is when to buy the cryptocurrency, considering its rollercoaster price history.

Introduction: Buying Bitcoin And When To Buy For The Most Profits

Most retail investors have realized by now that Bitcoin and cryptocurrencies aren’t a bubble or a fad despite what experts say, but are here to stay and are finding their niche in the financial world one way or another.

Institutional investors that once wouldn’t touch the most popular cryptocurrency due to fear of regulation by the United States government or elsewhere, now consider Bitcoin an attractive investment and something that everyone should have exposure to within their investing portfolio.

Buying Bitcoin has proven time and time to be a good investment, but at any moment depending on a variety of risk factors, Bitcoin could crash. As with any market, there’s a time to be bearish, and a time to be bullish.

This guide will explain how to know if Bitcoin will still rise and its a good time to buy or if a bear market will soon take over, as well as providing some hints at when to sell your coins at the peak of a bull market.

The Brief History Of Bitcoin Price: How Much Has The Cryptocurrency Grown?

Bitcoin price action over the last decade and more has been nothing short of incredible. The cryptocurrency has grown from relatively worthless, trading for less than a penny per coin, to prices well over $50,000 per BTC.

But it didn’t get there quickly, although it certainly did faster than anyone ever would have expected.

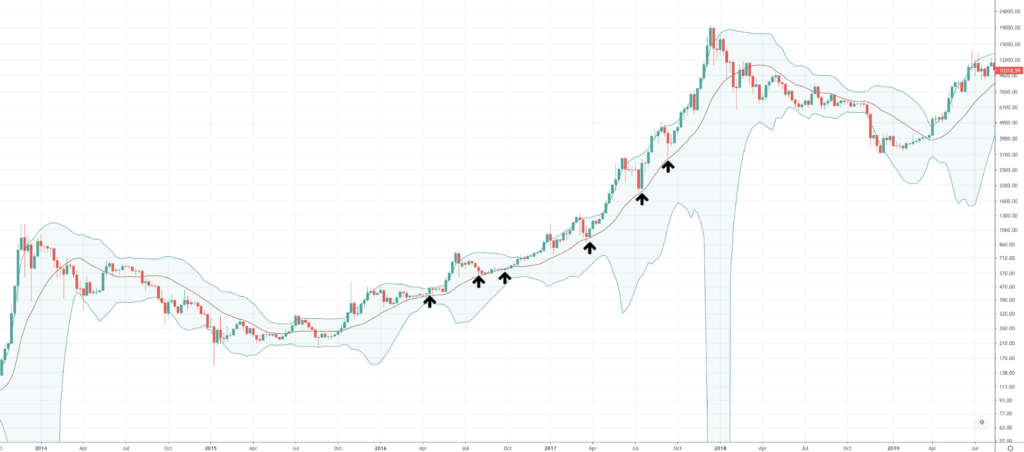

During the first several years of price action, Bitcoin was barely a $100 per coin, reaching over $1,000 in 2013 before the first substantial bear market.

When the dust finally settled, the still young cryptocurrency had another parabolic bull run and traded its way all the way to just below $20,000 per coin at the 2017 all-time high.

Another bear market broke out in 2018, leading to a price pullback to $3,000 and cementing Bitcoin’s status as a trader’s asset.

Those who were told to HODL, were suffering with substantial losses, or lost every penny they had in unrealized paper gains. The bear market is an ongoing reminder not to always blindly hold while others dump their coins on you, and to consider trading some BTC instead.

The bear market ended in 2019, however, when Bitcoin returned to over $10,000, but the pandemic caused a panic selloff and a return to lows in 2020. From there, however, the former all-time high was broken, and Bitcoin is back in price discovery mode as of current writing.

Bitcoin’s Rise in 2021: Can The Trending Crypto Keep Going, Or Is This Is?

Bitcoin in 2021 has already more than doubled in value, and the bull market might not be anywhere near over. Risk of a peak being in increases by the day, but there’s also risk in missing out on what could be dramatic upside as the price rises sharply.

Why Is Bitcoin Rising? Digital Gold, Dying Dollar, And More

Bitcoin rises due to an imbalance of supply and demand, network effect, and speculative FOMO. All of this is enhanced after each hard coded halving, which causes a dramatic shift in the already low supply, causing demand to outpace supply significantly and cause price to rise exponentially as a result.

Unlike gold markets, which when trending can increase production to meet rising demand, Bitcoin actually slashes its available new supply in half, instead driving up prices. The digital gold narrative has driven gold prices down and Bitcoin prices up.

At the same time, the massive amount of fiat money being printed by governments has caused investors to flock to Bitcoin due to its use as a hedge against inflation.

Will Bitcoin Continue to Rise? Bull Market Predictions For BTC

BTC price predictions are expected to reach as high as $1 million per coin in the future, with analyses or the top of the currency cycle projecting a peak of the current cycle in the hundreds of thousands of dollars per coin.

Bitcoin is almost certain to rise in the long-term, but in the short term and medium term, there is risk associated with a correction or crash.

How Low Could Bitcoin Go? Bear Market Data Examined

In the past, after a bull market has peaked, the leading cryptocurrency by market cap had typically crashed a full 80% or more. This data isn’t unique to Bitcoin, but any asset that loses its parabolic curve.

If cryptocurrency volatility turns fully downward from here, Bitcoin could fall to as low as $12,000 based on the $60,000 high.

However, if the bull market continues, past examples of corrections reach around 35%, while corrections in 2020 and 2021 have been very limited and range at around 10-20% max.

Is It Too Late to Buy Bitcoin? How Early Is It Still For Crypto Investors?

Famous philanthropist and billionaire hedge fund manager Paul Tudor Jones moved his money into Bitcoin from gold because he expected it to be the “fastest horse in the race against inflation” expecting it to outperform just about everything else markets have to offer.

Even as the asset’s price appreciated, he still called it like investing in “Google or Apple early.” And it’s still not too late to buy Bitcoin. Buying a whole coin might seem out of reach, but given its potential, the cryptocurrency can be bought in smaller increments called satoshi.

When Should I Buy Bitcoin? What You Need To Know About Timing Bull Markets

Buying Bitcoin has shown time and time again it is always a good idea to buy. Even those who thought they were out a fortune when the 2017 bull market ended eventually made money on their investment.

But when to buy is a much more difficult question to get perfect. Simply buying any time after the halving is the best recommendation, but for those that missed that date can still make effective buys when the cryptocurrency experiences a correction.

Bear markets in the past have retraced as much as 80% making that the best time to buy that isn’t related to the halving itself.

Anywhere from 60% and more of a correction results in the largest upside afterward and still makes for a profitable buy zone.

In bull markets corrections often range around 30%, while more recently have only been around 20%. These still have presented an opportunity to long with leverage for added opportunity.

To know when to buy Bitcoin on a smaller time frame, look for indicators to overheat, such a the RSI to reach close to oversold conditions.

Crossovers in the MACD and stochastic are also an ideal place to buy Bitcoin but can result in late signals.

The middle Bollinger Band can also be a target for where to buy Bitcoin during bull markets.

What Do You Do After Buying Bitcoin? What To Do With Your BTC

After buying Bitcoin there are several things you can do with it. There are also other ways to acquire BTC, including mining it.

Here are the most common strategies for how people manage their Bitcoin holdings:

HODLing

HODLing is another term for the common long term “buy and hold” long term investment strategy. Users are encouraged to “hold on for dear life” which is the acronym for the accidental misspelling of “hold” that has become popular crypto community slang.

However, HODLing, while advised by many, is a poor strategy during bear markets and even sometimes during bull markets, in which corrections can reset any gains.

Trading Bitcoin

Trading Bitcoin is a better solution, allowing those who own Bitcoin to maximize their returns on their investment, and avoid any of the negative impacts of the cryptocurrency’’s notorious volatility.

Trading involves either buying and selling BTC, or trading BTC-based derivatives contracts such as CFDs. With derivatives, traders can long or short Bitcoin and profit from both directions of the market. This is also an effective tool for building hedge positions. In this situation, traders would open small short positions whenever things get overheated in a bull market to try protect capital from any corrections, while keeping original long positions open.

Trading also lets investors avoid long drawdowns and build their BTC stack instead of losing money during bear markets.

Conclusion: Manage Bitcoin Investments Effectively By Trading On TradeQuasar

Buying Bitcoin at any point is a brilliant move and should continue to reward those that do throughout the years as the technology is adopted and price appreciation continues naturally.

But it is an even smarter move when you time any entries into the cryptocurrency market using fundamental factors and technical analysis tools that TradeQuasar provides to traders for free.

Things can become even more successful when investors learn to manage any Bitcoin positions effectively through trading to protect against bear market or correction risk, potentially profiting from it instead.

Never miss out on profits no matter which way the market heads next with long and short orders, stop loss tools, and much more through the award-winning TradeQuasar platform.

The trading platform even offers a unique copy trading module called Covesting in which Followers and Strategy Managers can earn profits from one another. Several other tools and opportunities for revenue are also offered, including Turbo and the company’s referral system.

Registration is free and anyone can deposit BTC, ETH, USDT, and USDC to get started margin trading today. There’s also a way to buy BTC directly for those that haven’t bought Bitcoin yet and are interested in buying Bitcoin for the first time.

Is It Worth It To Buy Bitcoin?

Buying Bitcoin has provided a higher ROI than any other asset in the history of investing and it just so happens to still be early. That’s how transformative this technology potentially is. What you do after you buy Bitcoin is the most important thing.

Is Bitcoin A Good Investment 2021?

Each passing day in 2021, the risk of Bitcoin is closer to a peak draw nearer, and makes buying now versus any time earlier a riskier bet. Depending on how long of a timeframe, investing in Bitcoin could result in capital loss, but trading Bitcoin instead is always effective.

Is It A Good Time To Buy Bitcoin Now?

Buying Bitcoin now is a good idea depending on what you plan to do with it. Buying to HODL is probably a mistake at this point, but anything is possible. Trading Bitcoin is always an option regardless of a bear or bull market and is more profitable than investing in crypto alone.

What Is The Best Time To Buy Bitcoin?

The best time to buy Bitcoin is right after the halving, or after a deep correction of 60 to 80% for the largest upside, or on a shorter time frame search for technical indicators to turn bullish.

Can You Lose All Your Money In Bitcoin?

It is difficult to lose all your money in Bitcoin unless the value of Bitcoin goes to zero or you trade your way to nothing - both of which are possible but unlikely. The only way to potentially lose all your money in Bitcoin is to be hacked or lose access to private keys.