Oil is one of the world’s most important commodities, and it is a commodity that not only fuels the globe, but it is also one that has a massive, and very important market. The oil market is one that can be very attractive to investors because, despite the push towards cleaner fuel, the reliance on this commodity is still very high.

The oil market of 2021 finds itself in an interesting position with the pandemic potentially coming to an end with vaccines rolling out, and a massive reopening of the travel industry and a return to work.

Crude Oil Price Forecast: For 2021 And Beyond

In 2021, there will be some more ‘black swans’ which are by definition unpredictable instances which affect the market already. A price War is brewing in Saudi Arabia after OPEC refused their deal, and the Coiv-19 outbreak is also influencing the entire global market still after a full year.

However, things are more than likely headed up for both Brent Oil, and Crude Oil once the recovery full begins.

When deciding to look into the oil forecast for its suitability to invest in over the coming year, five years, and ten years, it is also important to understand the market that the asset operates on and how it is defined. Firstly, Crude oil is the naturally occurring, unrefined petroleum product that is typically obtained through drilling.

When you come across the term Brent Crude Oil, this refers to the oil contract that investors will be looking at. In Europe, Africa, and the Middle East, the benchmark is North Sea Brent crude, which trades on the Intercontinental Exchange (ICE) and is more sensitive to overseas news while in North America, the benchmark for oil futures forecast is West Texas Intermediate (WTI) crude, which trades on the New York Mercantile Exchange (NYMEX), and is where the West Texas Intermediate crude oil price forecast happens.

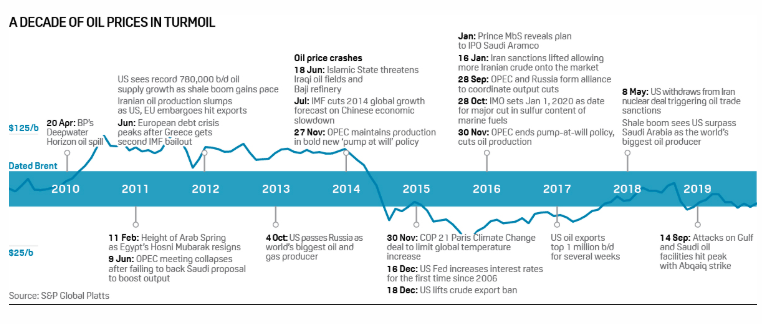

Oil Prices Historical Overview

The 20th and 21st century overview of the oil market can be defined heavily by the evolution of the middle eastern crisis, as well as periods of oil drought, and oil glut. Oil price is heavily influenced by political movements and uncertainty, especially related to the volatile area of the middle east. But they are also heavily influenced by market movements and that is what makes the last two centuries interesting times to look back over for a forecast into the future.

Oil production and markets started being taken seriously in the 1960s when the Organization of the Petroleum Exporting Countries (OPEC) was founded in Iraq. The entire goal of this organization was to take control of the oil market as the main contributors to the production of the resource.

However, with oil production and price control so heavily centralized in these OPEC countries, when political upheaval struck Iran in the 1970s, an oil crisis emerged as the global oil supply was constrained and the price of oil more than doubled.

In countering that, through the 1980s, there was an oil glut when non-OPEC countries like the USA and the UK increased their production to try and haul back some control over the market, but this added supply lowered the price of oil significantly.

During the 2008 financial crisis, the price of oil underwent a significant decrease after the record peak of $147.27. One barrel fell as low as $30.28 during the crisis. It was even argued that this collapse, which came at the time of the financial crisis, was due to speculation on prices before which overinflated Oil’s value.

Current Oil Prices

Oil is now trading at just over $73 a barrel, reaching higher than the pre-Covid high, but falling short of 2018 highs. Oil briefly traded at a low of $10 a barrel in a sharp V-shaped crash.

It is becoming more clear that the price of oil is heavily dependent on market and political moves, and has begun to recover in anticipation of an eventually reopening globally. Investors have also regained much of their risk appetite. Inflation is also a factor in improving oil prices.

Top Factors That Affect The Oil Prices

Oil is a commodity that is highly affected by geopolitical events and structures, as well as the global market performance. However, there are a few other factors that are worth considering when examining how the price of oil is determined.

The following factors should always be considered when gauging what the price of oil will do:

- OPEC

- Non-OPEC oil producing countries

- Exogenous shocks

- Global economic performance

- Alternative energy sources

- Strength of the US dollar

- Market speculation

OPEC has positioned itself as one of the most important organizations around the oil market. The collection of oil producing nations have aligned themselves to be very much in control of the production, supply, and regulation of price of a barrel of oil. It is a good thing that OPEC is looking to control the market for oil, as it is a finite resource and left unregulated, would be used up in an unsustainable way. This organization also takes into consideration other instances where oil’s price can be changed or manipulated and tries to ride these out. For example, the US has been upping its fracking industry which has led to OPEC warning of an increased supply of oil on the horizon.

While OPEC as an organization contains oil producing countries, there are other countries that also produce vast sums of oil who are not part of the membership. These are called Non-OPEC oil producing countries. Non OPEC countries are also rather big players on the world economic stage, and include countries like the USA, Canada and China. In fact, the US is the world’s biggest oil producer with 13 million barrels being produced each day in 2017.

Because oil is a commodity so closely correlated with markets and economies, it is highly susceptible to what is known as exogenous shocks; these are economic events that affect the price of a commodity in a way that cannot be explained or controlled — such as natural disasters or wars. An example of such an event was when Hurricane Katrina landed on the East Coast of the USA in 2005 and damaged oil supply lines. People panicked and the price of fuel rose as much as half a dollar in this time of fear.

Like any commodity though, oil is highly affected by supply and demand factors. Global economic performance is one such demand factor that is constantly shifting the price of oil. Major non OPEC countries, like the USA and China, as well as Europe, have the biggest demand for oil but as such, when global financial uncertainty strikes in these areas, the demand for oil usually drops rapidly. This again was seen in the 2008 financial crisis that slowed the globe’s industry and sent the price of oil falling by $100 over five months.

One of the new factors also influencing the price of oil is renewable energy. There is a strong drive in industry and consumerism for sustainable energy, of which oil does not fit the bill. As such, renewable energy sources are becoming bigger, and more popular, which again affects the demand for oil — and thus its price. If demand continues falling, and supply is still growing, the price of oil could rapidly drop in this shift to sustainable energy sources.

Through it all though, the oil price is also heavily affected by the world’s strongest currency — the US dollar. Like many commodities, oil is still exchanged in US dollars across the globe and because of this, a strengthening dollar price can actually make the price of oil fall — albeit nominally if all other factors remain the same. Then, vice versa, if the dollar weakens, oil will often rise.

Finally, as with any investment, the speculation that surrounds the market can greatly impact the price of the commodity. Oil is no different, especially with oil prices being set on the futures market which means the market is trading on a price point in the future. Market speculation happens when news events that can possibly affect oil start to emerge. For example, news on the use of more nuclear power in China can see people speculating on a drop in the price of oil due to less demand, and thus the market can react speculatively.

Oil Price Predictions For 2021

Amid the OPEC price war and fight for market share, and the impact of the Covid-19 virus, the demand for oil is likely to remain depressed in the short term, despite a larger recover from the Black Thursday V-shaped lows. However, things should begin to gain ground due to inflation and a resumption of global travel and a return to work.

If Oil prices can get back above the $75 level, prices could reach more than $100 per barrel. Long-term, due to inflation commodities like oil could rise sharply.

Crude & Brent Oil Price Predictions For The Future

The current market situation, amid the Covid-19 outbreak, is not expected to last for the long-term, however, its long term effect on the markets may be felt for a few years to come, especially with the threat of a recession also coming from this outbreak. This could ripple out and effect the long term oil price forecast, and will need to be taken into consideration. There’s also a delta variant spreading that is causing a return of lockdowns in some regions which could once again harm oil prices.

Oil price predictions long term are still vitally important to the oil investing market as the commodity, although quite volatile, is one that is often traded over longer periods of time. Oil is also a commodity that is still in high demand, and is finite, so it is expected to grow in demand over the long terms. Additionally, the prediction of oil in the long term is something that is important to different groups in the industry.

For example, having a more positive bias for oil price future predictions is something that would benefit OPEC as they want people to buy and invest in oil. However, groups like the International Energy Agency, which was charged with responding to the oil crisis, might be expected to produce alarmist forecasts.

It is for this reason why you can see that predictions from different sectors are usually quite different.

Oil Demand Forecast

Taking this into consideration, and the unpredictable nature of future oil price predictions, it is still important to put some sort of estimate as to what will affect the demand of oil, and how that can play out in moving the price. The recent Covid-19 outbreak is a clear example of an exogenous shock, as no one could have seen this coming. But now, people will predict its impact on the global economy and how that will influence the demand for Oil.

This instance is one of more immediate effects. Covid-19 is set to work its way through the globe and soon die off, but its ramifications could leave the economy in ruins, and thus have a major impact on the price of oil for the next couple of years. A delta variant causing lockdowns again is also making conditions for oil prices shaky again.

However, there needs to be other considerations taken into effect. For example, as the globe rapidly modernizes, and the concerns about global warming increase, there is expected to be an uptake of renewable energy sources which will also affect the global oil markets.

Then again, the current Price War that has broken out in OPEC is also seen as a short term threat to the price of oil, but it too can have longer ramifications as the already hostile Middle East area grapples with infighting and uncertainty.

If the Middle East remains a hotbed of geopolitical upheaval, the price of oil again can be impacted — but this impact may be positive for the price of oil as it could lead to lower supply in the coming years.

Expert Oil Price Predictions

A recent update in a CNBC article has presented three different price predictions from three top financial giants from across the globe, including Bank of America, JP Morgan, and Goldman Sachs.

JP Morgan and Goldman both see oil prices trading at around $80 a barrel, suggesting that the key level of $75 is broken.

Bank of America expects oil to run even hotter, reaching more than $100 per barrel and triple digits for the first time since 2014.

Oil Price Forecast Next 5 Years (Until 2025)

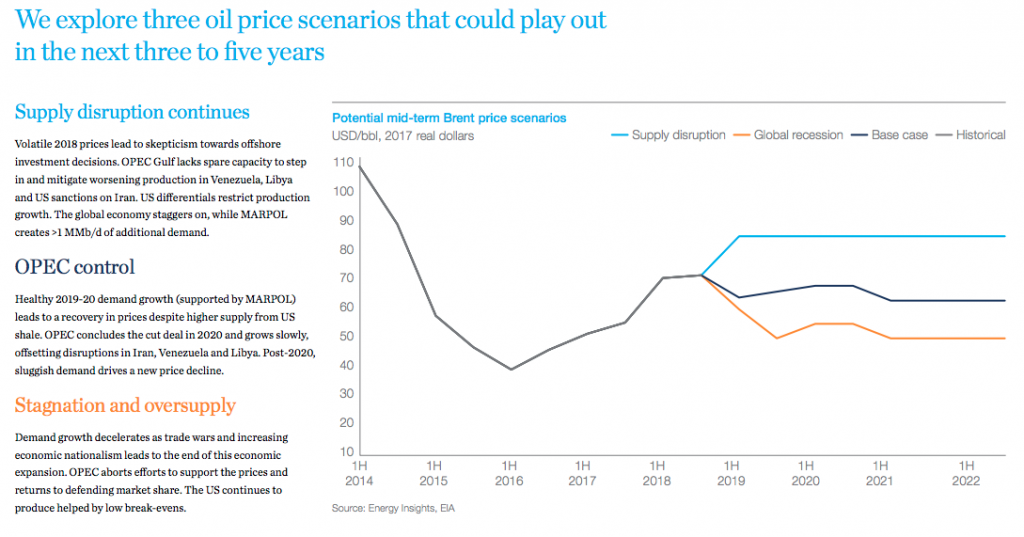

Oil’s price, especially over a period of five years, can be very volatile and change drastically. For example Brent Crude prices fluctuated from as high as US$125 a barrel in 2012 to as low as US$30 per barrel in January 2016.

Inflation could push prices higher, even despite less reliance on fossil fuels.

Essentially, there is a widely held belief that oil prices in the next five years will be influenced by one of three things. Firstly, supply disruptions could lead to a huge surge in the price of oil where it might rise in value and end up at $90 a barrel. The reasons this could play out is because if the International Maritime Organisation finds the shipping industry unprepared to the new regulations, and OPEC lacks capacity to mitigate the worsening production in Libya and Venezuela, as well as Iran sanctions.

A more modest prediction sees OPEC continuing to grow and push its weight around, despite increased production from the US. If OPEC does retain control, experts forecast the average crude oil prices in the $60-$70 range, but as for the crude oil forecast for next week, for example, things are less positive.

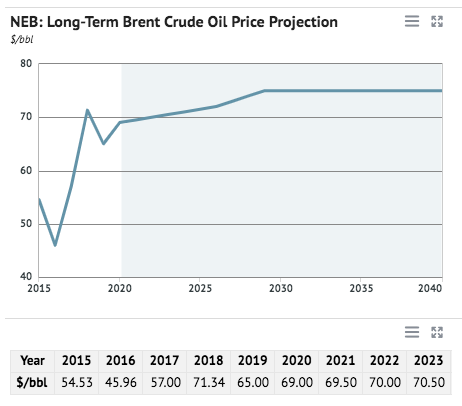

Oil Price Prediction For Next 10 Years (Until 2030)

The next decade in the oil price forecast 2030 may well be more positive than the next five years as the additional time allows for a recovery from a global recession, as well as a period of reinvigoration and growth. In fact, there are many forecasts that are putting the next demand peak for the oil price in 2030.

The International Energy Agency (IEA) said in its latest annual World Energy Outlook.

“Oil demand for long-distance freight, shipping and aviation, and petrochemicals continues to grow. But its use in passenger cars peaked in the late 2020s due to fuel efficiency improvements and fuel switching, mainly to electricity. Lower battery costs are an important part of the story: electric cars in some major markets soon become cost-competitive, on a total-cost-of-ownership basis, with conventional cars,” the IEA said in its outlook to 2040.

Another important factor for the next 10 years is how OPEC will deal with the growing market share that the US is taking in the energy stakes. The US and its Shale Energy production is a big threat to OPEC, but the shale energy is slowing.

Summary: What is the future of the oil?

Oil remains a commodity that is vital to how the world and the economy works. It is a commodity that is looking to be phased out, but this phasing out is still more than 50 years away and thus has an important role to play going forward.

But, more than this, the market of oil is also an important one and it is a market that attracts a lot of investors as it has many different facets that influence it, providing investors big opportunities with both the dips and the rises in price.

Even with today’s price of oil being so low, and in a real state of panic, for some investors this represents a buying opportunity that not many will probably see again in their lifetime. For this reason, it is worth looking into investing, and starting up is not as difficult as many would believe. TradeQuasar, a multi-commodity trading platform has quick and easy sign up that allows investors to begin trading in oil in a matter of minutes — sign up here.

Why is the oil price dropping?

Oil’s price was dropping due to significantly less global demand, and a transition into greener energies. But oil prices have been rising due to inflation and front running of demand.

Will oil prices go up?

Oil remains an important commodity globally and will have a demand for many years to come. With travel about to reopen and people getting back to work post pandemic, oil demand should rise again and in turn prices will follow. With stimulus money driving up the price of commodities and increasing the rate of inflation, oil could increase in the future.

Who controls oil prices in the world?

Oil prices are mostly determined by an open market of speculative traders and buyers and sellers. However, the market is also regulated and controlled by organizations like OPEC who do their bit to control this finante resource.

Who is the largest producer of oil?

As a stand alone nation, the US produces the most amount of barrels of oil per day. However, when groups collaborate, such as OPEC, these groups produce far more than anyone nation and they work together as one entity.