There are a whole host of indicators that you can use as a cryptocurrency trader, and in this article, we look at some of the 10 best indicators that can give you a bit of a “heads-up” as to where the markets may be going next.

What Are Indicators for Cryptocurrency?

Traders often use indicators to get an indication as to where the market may be ready to go. They can be used to show price behavior, as well as momentum. Strategies then can be based upon indicators, allowing the trader to follow the market and its movement.

What Are the Types of Indicators for Crypto Trading?

There are a couple of major categories in which you can stuff indicators, including technical analysis indicators and cryptocurrency social media indicators. Unlike other forms of financial assets, crypto does tend to pay close attention to social media. As for the technical indicators, you will find these are similar, if not identical, to many indicators you may use in other markets.

Technical Indicators for Cryptocurrency Trading

In the more established and traditional markets, traders can rely on most technical analysis tools, such as the ones we will discuss, to forecast the future price movement based on market data. However, cryptocurrency is a relatively new asset, so the lack of history and market data makes predicting challenging.

You first need to consider cryptocurrency’s volatility because it is more volatile than traditional mainstream assets. Some indicators work better than others, such as the On Balance Volume (OBV) indicator. It helps track down money flow from larger institutional investors into the market. The OBV studies the accumulation of trading volume over previous days, weeks, and even months.

If the indicator rises, it’s a sign that price momentum is picking up. If it is decreasing, selling pressure is relatively high, giving traders a chance to sell the market to make profits.

Social Media Indicators for Cryptocurrency Trading

More than any other type of financial trading, social media heavily influences cryptocurrency. As many crypto traders are relatively young, social media interaction and online marketing strategies tend to have a somewhat predictive nature as to where the price of a cryptocurrency will go.

Social media indicators are much more helpful with smaller market cryptocurrencies, as they can experience greater price movements if a famous social media influencer or celebrity mentions the project.

Social media activity in search traffic indicates whether prices will rise or fall, especially with smaller markets, as it takes much less to move them. Google trends are one of the better and more popular tools used to track social media and search engine buzz, suggesting that traders may be looking to purchase a coin, or at the very least, that it is being noticed.

Another couple important indicators for the cryptocurrency market are the Crypto FOMO indicator and the Fear and Greed indexing crypto. Emotions, especially when it comes to fear and greed, are strong drivers of crypto market behavior.

Best 10 Indicators for Cryptocurrency Trading

There are many indicators out there that you can use to determine the trend, strength, and momentum of a market. Below are some of the most commonly used and robust indicators that crypto traders use:

Relative Strength Index (RSI)

RSI, or Relative Strength Index, is a popular technical indicator that measures an asset’s strength and weakness during price changes. The main goal of the RSI is to determine whether an asset is overbought or oversold.

The calculation formula is as follows:

RSI=100-100/1+RS

RSI measures the average periods that close higher in price divided by the average of periods that fall in price. The standard setting is 14 periods or candlesticks, which can be adjusted for your system.

If the RSI is below 30, it is considered to be oversold. If the RSI is above 70, it is considered to be overbought.

Pros:

- Easy to use with any system

- Efficient in catching loss of momentum

- Designed to work in non-trending zones

Cons:

- Completely ignores volume

Stochastic Oscillator

The Stochastic Oscillator is designed to measure momentum. It compares a specific closing price of the asset with a wide range of prices during a particular time frame. The indicator generates overbought and oversold trading signals using a specific range of values.

The calculation formula is as follows:

Slow %K= 100 [Sum of the (C – L14) for the %K Slowing Period / Sum of the (H14 – L14) for the %K Slowing Period] Slow %D = SMA of Slow %K

C=Latest Close

L14=Lowest low in the last 14 days

H14= Highest high for the same period

%K Slowing period is 3

One of the advantages of this indicator is that you don’t have to measure it manually. The overbought signals are created above 80, while a reading below 20 signifies an oversold condition. It generally is favorable to use the Stochastic Oscillator in a range-bound environment.

Pros:

- Clear signals to enter or exit

- Signals occur frequently

- One of the most common indicators

Cons:

- Can generate false signals in a trending environment

On Balance Volume (OBV)

OBV, or On Balance Volume, measures and assets volume flow to predict potential price changes. It also has the added benefit of determining the strength of a signal to buy or sell an asset.

It’s best thought of as a cumulative tool, as if the price of an asset closes higher for a candlestick, the volume for that day is added to the total OBV reading. If the asset’s price closes down, the volume is subtracted from the total. If the price stays unchanged, no calculations occur. OBV works well as a Bitcoin technical indicator.

Pros:

- OBV is considered a leading indicator

- Performs very well during a trending market scenario

- Excellent at pointing out divergences

Cons:

- Can produce false signals when used during short time frames

- Not suitable for scalping

Bollinger Bands

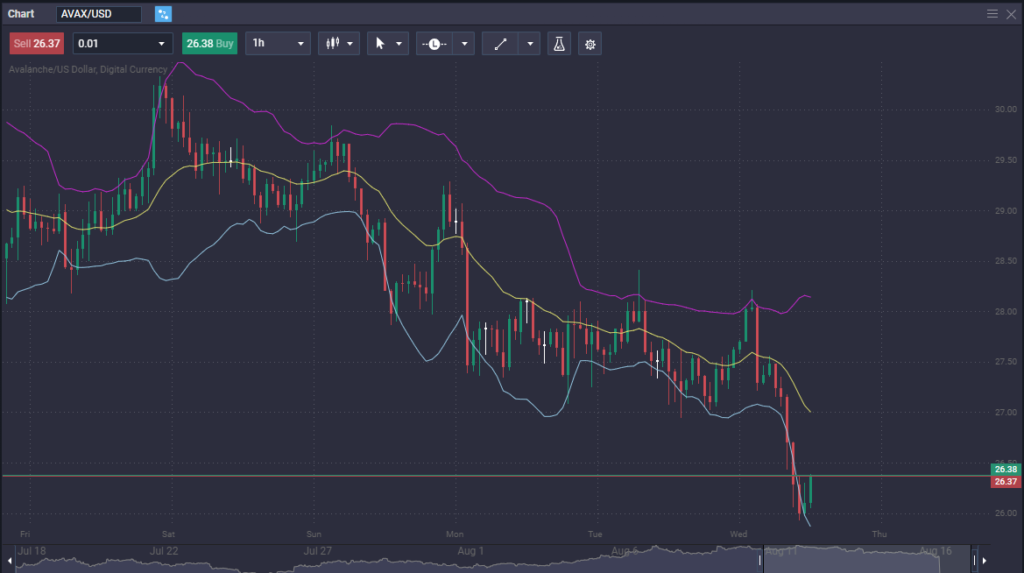

Bollinger Bands on TradeQuasar (AVAX/USD pair)

The Bollinger Bands indicator determines whether a market is within a specific band of normalcy. The indicator allows the lower and upper bands to move in line with fluctuations in price. It measures 2 standard deviations by default, where 96+ percent of all price action occurs.

If an asset’s price moves beyond one of the upper or lower bands, it means that the price reversal could happen. Bollinger Bands are widely used due to the popularity of the indicator in the stock market and are an excellent way to determine markets that have moved too far. Most traders use this indicator incongruence with other ones.

The calculation formula is as follows:

Middle Band: SMA or simple moving average of 20 days

Upper Band: SMA over 20 days+(Price deviation over 20 days *2)

Lower Band: SMA over 20 days-(Price deviation over 20 days*2)

Pros:

- Easy to use

- Can help identify new short-term or long-term trends

- User-friendly

Cons:

- Does not predict price patterns

- Rarely used alone

Moving Averages (MA)

Traders widely follow Moving Averages. A moving average plots the average closing price of an asset over the last “X” candlesticks. For example, a 20 Moving Average will plot the average closing price of the previous 20 candlesticks.

Every time a new candlestick is printed, the calculation shifts forward one candlestick to measure just the previous 20. Traders can use any amount of candlesticks they want, but it should be noted that the most common ones are the 9, 20, 50, 100, and 200.

There is the Simple Moving Average, which is just the calculation of the previous “X” closing prices, and there is the Exponential Moving Average, which emphasizes the most recent candlesticks, making it much more sensitive.

The idea behind Moving Averages is that it shows the overall trend, and it can be used for dynamic support and resistance. If the Moving Average slopes from the lower left to the upper right, you know you are in an uptrend. If it slopes from the upper left to the lower right, you are in a downtrend. It’s also worth noting that the Moving Average is one of the best Bitcoin technical indicators, as so many retail traders are involved in that market.

The calculation formula for a Simple Moving Average is as follows:

A1+A2+A3, etc./n

A = Average in period n

n= Number of time periods

Pros:

- Easily identifiable trends

- Widely used

- Works well with most systems

Cons:

- Should be used in trending markets only

Average Directional Movement Index (ADX)

ADX or Average Directional Movement Index is an indicator used to measure a particular trend’s overall strength. It measures the average of the expanding range of price values during that trend.

The indicator takes the mean of values over a certain period. If the ADX is over 25, it signifies that there is a strong trend in play. Alternatively, if the ADX is below 20, no strength or trend is present.

The ADX will sometimes decline, suggesting the trend might be weakening. If the ADX is rising, it indicates the trend is strengthening. The ADX has 2 other indicators, which the trader doesn’t have to worry about.

The calculation formula for the ADX indicator is as follows:

ADX = MA [((+DI) – (-DI)) / ((+DI) + (-DI))] x 100

Where:

+DI – Plus Directional Indicator

-DI – Minus Directional Indicator

Pros:

- Available on almost all platforms

- Can be used with other indicators easily

- Easy to use

Cons:

- Not suitable in all market conditions

- May show wrong signals when used by itself

Moving Average Convergence/Divergence (MACD)

The MACD or Moving Average Convergence Divergence indicator is a wildly popular and relatively straightforward indicator to implement. It’s quite effective in providing strong trading signals for crypto. It is a trend-following indicator that measures whether the direction of the short and long-term momentum is the same or not.

MACD has four components, the MACD line, the Signal line, the Histogram, and the Zero line.

The calculation formula for MACD is as follows:

26 period EMA (Exponential Moving Average) – 12 period EMA (at closing prices)

A positive reading means that there is upside momentum. Alternatively, a negative reading indicates that there is downward momentum.

Pros:

- Easy to use

- Easy way to measure trend

- Can be used with other indicators

Cons:

- Can generate false reversals

Fibonacci Retracement

The Fibonacci Retracement tool predicts resistance and support levels for an asset. The indicator can be complicated to use at first, but it can also help you understand the price actions of a market if applied correctly. As a general rule, there are 3 levels of retracement that people follow, including 38.2%, 50%, and 61.8%.

Traders will use a retracement of those percentages to look for potential ways and opportunities to get involved in an existing trend. It can be used in both trends and downtrends and is commonly charted by other traders worldwide.

The calculation formula for Fibonacci Retracements is as follows:

UR= High price- {[High Price-Low Price] *percentage}

Note that this formula is for an upward trend. If you are measuring the downward trend, you replace the initial high price with a low price.

Ichimoku Cloud

This indicator is a collection of other indicators that display potential resistance and support levels in a market. It also shows trend direction and momentum.

It measures multiple averages and plots them all on a chart. The indicator uses these values to create a cloud that forecasts the time a price may find support or resistance.

The Ichimoku Cloud indicator has five lines, each with its formula:

Conversion line=9-PH+9-PL/2

Baseline = 26-PH+26-PL/2

Leading Span A=CL+ Base Line/2

Leading Span B= 52-PH+52-PL/2

Lagging Span= Close plotted 26 periods

PH = Period high

PL = Period low

CL = Conversion line

Pros:

- Measures support and resistance levels

- Strong efficacy

- Can be used for various market trends

Cons:

- Extremely complicated formula

- Can be difficult for novice users

Aroon

Aroon indicator on the TradeQuasar platform

The Aroon indicator measures the strength of a trend and also evaluates changes in the underlying asset’s price. Furthermore, it measures the time between highs and lows over a certain period.

The calculation formula for Aroon is as follows:

Aroon Up= 25-Period Since 25 Period High/25*100

Aroon Down= 25-Period Since 25 Period low/25*100

The calculation keeps track of low and high prices during the last 25 candlesticks. To ensure this calculation is accurate, you should measure the number of periods in the previous lows and highs. Once you have found them, use them in the formula above.

When the Aroon Up line is above the Aroon Down line, it indicates bullish price action. Alternatively, if the Aroon Down line is above the Aroon Up line, it means bearish price action.

Pros:

- Aroon can help define an overall trend

- Can be used for long-term and short-term trading

- Known to generate high-quality signals

Cons:

- Can produce lagging signals in certain conditions

The Best Strategy with the Best Crypto Indicators

The best strategy for using indicators is going to be a highly personalized situation. Therefore you need to experiment, but the following examples can be used to determine your own way forward.

Some of the following strategies can be used for trading cryptocurrency:

- RSI and MACD are the most straightforward technical indicators that you can use to trade crypto

- When the RSI is below 30, it suggests that the market is oversold, and it is the right time to start looking for a buying opportunity

- If the RSI is above 70, it means that it could be time to either short the market or take profits if you already have them

- If the RSI is elevated and the MACD line falls, it could be time to start selling

You need to understand that each indicator works differently, so the strategy can also vary. However, You can use these basic points to start building a trading strategy that you are comfortable with.

Tips for Using Indicators for Cryptocurrency Trading

If you are trying to become a profitable crypto trader, you need to have a strategy. The question, of course, is whether or not you know how to build one. The following steps can help you start to build a profitable and worthwhile crypto trading strategy:

- There are different trading strategies that include: day trading, scalping, trend trading, position trading, and swing trading. That being said, each of them follows fundamental rules

- Every trader should choose a trading interval based on their strategy. For example, day traders use low time frames to predict price movement within a certain amount of time. Swing traders may use weekly charts to catch more significant moves

- Once the timeframe is settled, you then begin to add indicators and oscillators to forecast market trends and price movements

- It’s crucial to understand that using one particular indicator is not necessarily adequate to be a trading strategy. Traders tend to use multiple indicators at one time to attain accuracy

- Looking at technical indicators and price patterns is a part of every technical trading strategy that helps traders evaluate whether or not the trend is strong or shows some type of divergence

- A robust strategy also will include adding at least some fundamental analysis to the picture

Conclusion

The first thing you must keep in mind is that there is a world of indicators available to the crypto trader. Because of this, you will have to experiment with what works best for your psychology, trading strategy, and timeframe chosen.

You should also remember that while being helpful, indicators are not the be-all and all of trading. You also need to understand that markets can do anything at any given moment, so money management is crucial as there is no “100% sure thing.”

Make sure you are using a strong platform, such as the one offered at TradeQuasar, that has plenty of indicators for you to use. Remember, many technical analysis strategies require several indicators, so you must have those options available.

Furthermore, ensure you backtest any trading strategy you plan to use. Knowing how it performs over a longer time frame gives you more confidence and expectancy in your trading.